5-STAR Business Network

I am always amused to see the starry eyed stories of success of the companies in the business press.

Many of the stories do not go deep into the real reasons for that success or to trace how transitory it can be, if those reasons disappear.

It was not that long ago that Apple was the darling of the newspapers and magazines.

The Company could not do anything wrong, and its market valuation was almost bigger than that of PIGS combined market value.

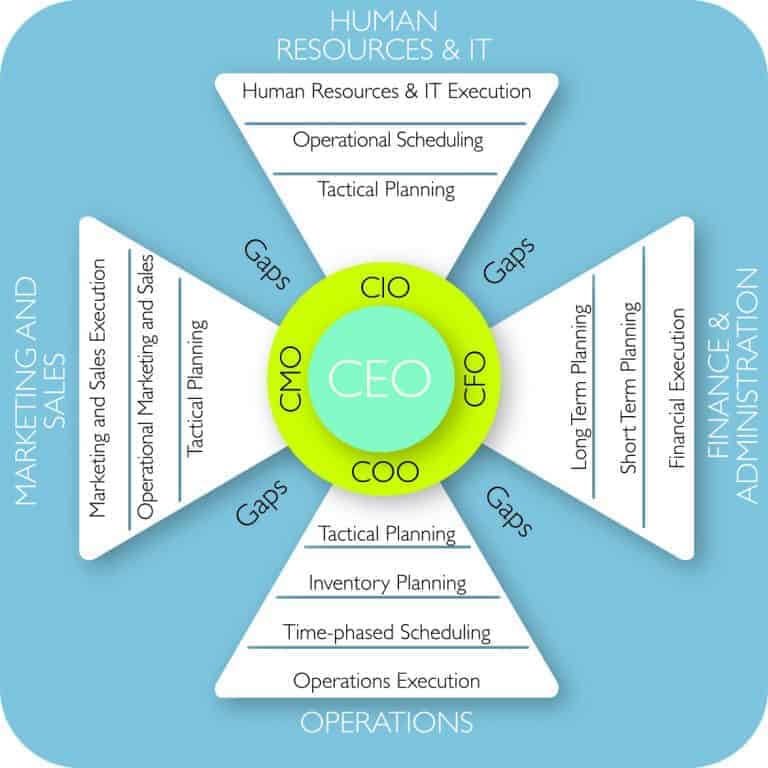

I noted the key reasons for its success – its 5-STAR Business Network – in my just released book.

I also cautioned that managing this business network, carefully nurtured by Steve Jobs based on his personal relationships as much as organizational protocol, will be delicate task,

particularly after Steve Jobs was gone.

That is why this article in Wall Street Journal today caught my eye.

I think by now it is a common knowledge that after Steve Jobs, Apple just is not the same company. A number of missteps have been noted in the press.

There were missteps when Jobs was around, but somehow they did much lesser damage then. As one commentator noted on the WSJ article –

Some Introduction About 5-STAR Business Network

Where Steve Jobs goes, so goes Apple.

I think by now it is a common knowledge that after Steve Jobs, Apple just is not the same company. A number of missteps have been noted in the press.

There were missteps when Jobs was around, but somehow they did much lesser damage then. As one commentator noted on the WSJ article –

For example, see this news report –

Apple shares plummeted more than five percent Wednesday after Cirrus Logic, a supplier of Apple components, slashed its own profit guidance, suggesting its Apple business had weakened.

The news report goes on to say Supply Chain:

Shares in Apple are well below their 52-week peak above $700 in September as the California tech giant faces tougher competition from South Korea’s Samsung and others in the busy smartphone and tablet technology space.

The sell-off came after Cirrus, which relies on Apple for a majority of its sales, warned that profits for its fiscal fourth-quarter, through March 30, would be lower.

Investment Banks were quick to downgrade Apple and comment on its trouble based on the information from Apple’s supplier.

To my knowledge, only one journalist, Adam Satariano of Bloomberg could make the connection across the entire 5-STAR Business Network and see the ripple effect percolating through the business network.

He commented in his article:

Apple’s breakneck growth to $156.5 billion in revenue last year, from $24.6 billion in 2007 when the iPhone debuted, supports an ecosystem of at least 247 suppliers across the globe.

They relied on Apple to deliver $30.1 billion in orders in the latest reported quarter, according to supply-chain data compiled by Bloomberg.

As a result, many are now vulnerable after building up inventory in anticipation of continued growth, according to Michael Hasler, a lecturer at the University of Texas in Austin.

“This is the downside of that really positive story of being an Apple supplier,” said Hasler, a former supply-chain executive at Applied Materials Inc. “Your fortune is directly linked to Apple. Until recently, that hasn’t been a bad thing.” …

…While Apple accounts for a large chunk of Cirrus’s revenue, Jabil Circuit gets 13 percent, Broadcom 15 percent and Flextronics 8 percent of their sales from Apple, according to supply-chain data compiled by Bloomberg.

There is not a better example of the prominence of the 5-STAR Business Network in today’s economy.

We will see the bull-whip effect ricochet across the global technology sector, and beyond. A Company is indeed known by the company it keeps.